The answer to which credit bureau gives the lowest, middle, or highest FICO® or Vantage® score reveals how the industry operates and possible ways for consumers to boost their qualifications.

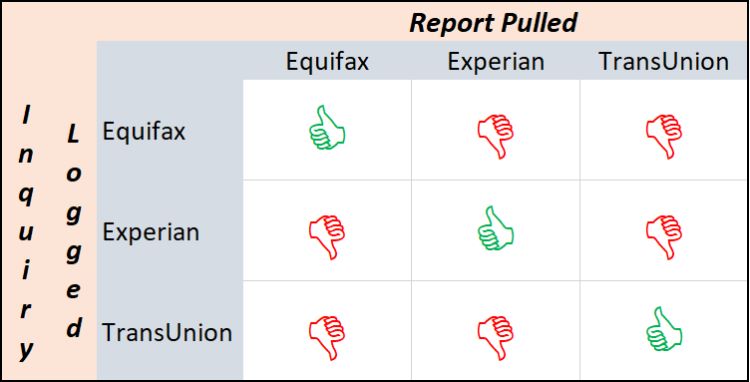

Hard inquiries drop scores by about 5 points but only appear on file at the reporting agency supplying the file. Therefore, the lender preference table for your three-digit zip code area often determines the answer.

Meanwhile, the reasons behind why a score is highest or lowest could reveal ways to identify correctable errors that improve your qualifications for a mortgage, personal loan, or automotive financing.

Lowest Scoring Bureau

The credit bureau that gives the lowest FICO® or Vantage® score tends to be the one lenders use the most in your geographic area. At the three-digit zip code level, lenders typically slice the pie (between Equifax, Experian, and TransUnion).

Two primary criteria for determining market share (the amount of negative data and pricing) drive the allocation of hard inquiries, influencing scores further.

More Negative History

The credit bureau that scores lowest overall in your geographic area tends to have more negative entries on file than its competitors. Your payment history is the number one rating factor (35%) that goes into the equation.

One account that defaults wipes out the lender’s profits of twenty customers who pay on time. Therefore, lenders prefer to pull the report most likely to help them avoid losses: the one with more derogatory data.

- Most nationwide finance companies report to all three

- Some regional entities report only to one via a local affiliate

As a result, the agency with the more unique companies reporting to their system wins more business from lenders in a specific three-digit zip code area. Then, the additional hard inquiries push scores down further.

More Hard Inquiries

The credit bureau that scores lowest will also have more hard inquiries on file. A hard inquiry reduces your rating by about 5 points for at least one month – but only at the agency that provided the report.

Many lenders pull only one report per transaction, meaning the hard inquiry does not appear on two out of three files! The agencies do not share inquiry data. Therefore, this metric could have wide divergence, driven solely by the price charged.

Cheapest Pricing

The credit bureau that outputs the lowest score in a specific region sometimes has the cheapest prices. Equifax, Experian, and TransUnion compete fiercely for business from the lenders, and sometimes, their customers decide which one to use based on what they charge.

Accuracy and quality are the most important criteria for determining which agency to use, but lenders often find little differentiation at the three-digit zip code level. Therefore, price is usually the tiebreaker.

In other words, the company with the cheapest pricing often wins the most market share from a particular lender, garnering the lion’s share of their hard inquiries. In turn, consolidating harmful entries affects scores in a specific geographic region.

Bureau With Middle Score

Many prospective home buyers want to know which credit bureau gives the middle score because mortgage companies use the center result when evaluating applications.

The essential credit bureau when buying a house includes unique derogatory data (if present). Mortgage lenders consider merged reports pulled from all three (Equifax, Experian, and TransUnion). However, they do not calculate a score from the merged information.

Instead, they see a score calculated by each of the three agencies but only consider the middle number.

How to Find

Finding the bureau that shows the middle score for a mortgage can be tricky because home lenders often use an industry overlay rather than a general-purpose equation.

- Most educational scores provided to consumers are general-purpose algorithms that predict future delinquency on any trade line: unsecured revolving credit cards and personal loans, secured auto financing, and others

- Industry overlays used by many home lenders are specialized equations that predict future delinquency on secured mortgages: the type of transaction they are underwriting

The agency that supplies the middle educational credit score will also give the inner mortgage overlay result, as the two equations rely on the same data set.

How to Raise

Often, the best way to raise your middle score to improve your mortgage qualifications is to correct any harmful errors that might hamper the lowest score. This method works exceptionally well when the mistake appears on only one file.

Disputing negative items on your consumer report is more likely to succeed when only one displays the information erroneously. It signals a standard error the agencies can correct themselves.

- Errors that originate at lenders frequently appear on all three files

- Mistakes unique to one represent identity-matching issues

- Missing positive information (fragmented files)

- Derogatory data from another person (merged files)

In this case, you can boost your middle score by removing negative information belonging to another person – the one with the lowest rating. The two results might switch places, improving your qualifications for a mortgage.

Highest Scoring Bureau

The credit bureau that tends to give the highest FICO® or Vantage® score is the one lenders tend to use less frequently. They have fewer derogatory items in your three-digit zip code area, their pricing is more expensive (fewer inquiries), or they have more positive entries.

Lenders are less likely to use the agency with the highest score. But examining their files could provide a critical clue for improving your borrowing qualifications: missing helpful entries.

More Positive History

The credit bureau with the highest score could have more entries with positive payment history on files in a particular three-digit zip code area. On-time entries can boost your ratings across several rating factors.

- Payment history makes up 35%

- Amounts owed control 30%

- Length of history influences 15%

- The mixture of account types shapes 10%

- New account activity affects 10%

For instance, an old tradeline with a perfect payment history could improve rating factors 1, 3, and 4. If one or two agencies do not display this information, you can correct another frequent error: fragmented files.

Fewer Fragmented Files

The credit bureau with the highest score could have fewer fragmented files, resulting in missing positive information that could help your ratings. They might think you are two people instead of one.

Fragmented files occur when your personally identifying information is inconsistent, creating matching difficulties.

- Transposed digits on social security numbers and date of birth and other clerical errors (typos)

- Inconsistent presentation of nicknames (Mike, Miguel, Michael) and generation codes (junior, senior, etc.)

- Address variations such as missing apartment numbers, street directionals (north, south, east, west), and PO boxes

- Legal name changes after marriage (maiden, married, hyphenations)

- Changes of address after moving to a new home

You will know you have a fragmented file issue if the lender communicates the positive information to all three agencies rather than just one. Contact this source to verify how they report and correct any identity anomalies with them.

If this does not correct the issue, file a dispute with the offending bureau stating they are missing helpful information. Include account numbers as a reference point.