Personal loans help patients afford elective surgery when health insurance does not cover all of the procedure expenses.

Most insurers do not cover operations that reshape healthy tissue to improve appearance but will pay for medically necessary surgeries – if you have coverage in force.

The most critical eligibility criteria are keeping the amount borrowed as small as possible so you can afford the monthly payment plan to follow. Your credit score and income are secondary.

Many surgeries fall into a gray area, where insurance might pick up most of your expenses – if you can demonstrate that parts of the procedure are medically necessary.

Sponsored Listing

Paying for Elective Surgery Articles

No Credit Check Financing Options for Plastic Surgery

Your choice of words matters when figuring out how to pay for plastic surgery with bad credit or no history. Determining whether your plastic surgeon will perform reconstructive or cosmetic surgery is essential because the type directly influences your financing …

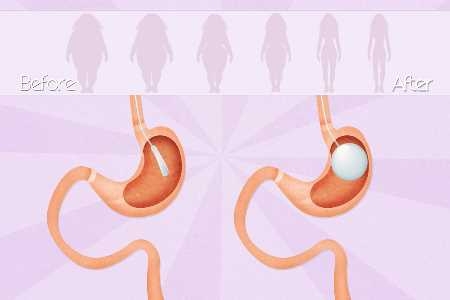

How To Pay For Weight Loss Surgery with Bad Credit

How can you finance bariatric surgery with a low credit score? Lenders deny patients less likely to pay back their money. Keep the amount borrowed as small as possible. Affordable payments lower the chance you fall behind, helping lenders approve …

Medicaid For Excess Skin Removal After Weight Loss?

Medicaid will sometimes cover excess skin removal after weight loss surgery. The bariatric procedure type does not matter (gastric bypass, lap band, vertical sleeve, or gastric balloon). The medical necessity of each procedure is of far greater importance as it …

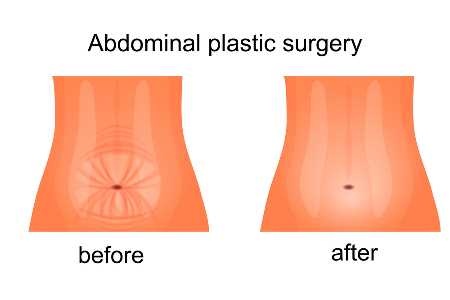

Doctors Accepting Medicaid For Tummy Tucks, If Covered

Medicaid typically covers medically necessary surgeries that treat an illness or injury or correct a functional impairment. Meanwhile, Medicaid and other insurance programs deem abdominoplasty cosmetic as it improves one’s appearance, and the medical benefits are unproven. Even if you …

When Does Medicaid Cover Plastic Or Cosmetic Surgery?

Medicaid sometimes covers plastic surgery even when low-income patients pursue the procedure for cosmetic reasons: to improve appearance or symmetry. The key to success is proving in advance that the operation is medically necessary or reconstructive: treating an illness, injury, …

Free Plastic Surgery: Getting Health Insurance to Cover

The words you use and the questions you ask determine whether you can get free plastic surgery. Your health insurance and IRS tax savings can cover most expenses when the procedure step is medically necessary: addresses a disease or health …

How To Get Gastric Bypass For Free: Government Funding

If you need weight loss surgery but can’t afford it, you might want to explore government-funded programs, assistance for low-income patients, and free grants. The government funds three types of insurance (Medicaid, Medicare, and ACA plans). Getting them to cover …

Financial Assistance: Paying for Surgery Without Insurance

If you need surgery and have no insurance, the one sure way to get financial assistance is to connect with a third party with deep pockets legally required to pay the expenses. Looking for grants, free services, clinical trials, makeover …